Maas Classification Holdings has gradually carved aside a diversified footprint round the structure material, municipal framework and get, residential and you will industrial a property, and you will production. The fresh FY25 efficiency emphasized the advantages of which prolonged design. Funds edged right up 1% so you can $ten.7 billion, when you’re EBIT and you can NPAT increased 8% and you will 9% to help you $step one.5 billion and you can $924 million respectively. Margin discipline are apparent, that have EBIT margins broadening by the 93 base points to 14.3%. Boral is a standout, delivering a great twenty six% boost in EBIT to help you $468 million, showing both prices discipline and you may functional efficiencies. WesTrac in addition to provided which have a good 2% EBIT uplift, reinforced by lingering fleet renewals and you may robust consult inside Western Australia’s info market.

- Pre-income tax profit along with rose to another-than-requested £81.4m, even if that has been underneath the checklist £107m the brand new club large made out of straight down full sales pre-COVID in the 2018.

- This allows for most sweet neon landscape (Magenta heavens! Multilingual billboards!) and you may provides an opening roof pursue quite well.

- “Protests and you can riots was the conventional information, banks was boarding up their screen, and you will emergency notice have been prompting visitors to remain inside after curfew,” he wrote.

- Since the another Chase checking customer, earn $125 once you open Chase School CheckingSM and complete 10 being qualified deals.

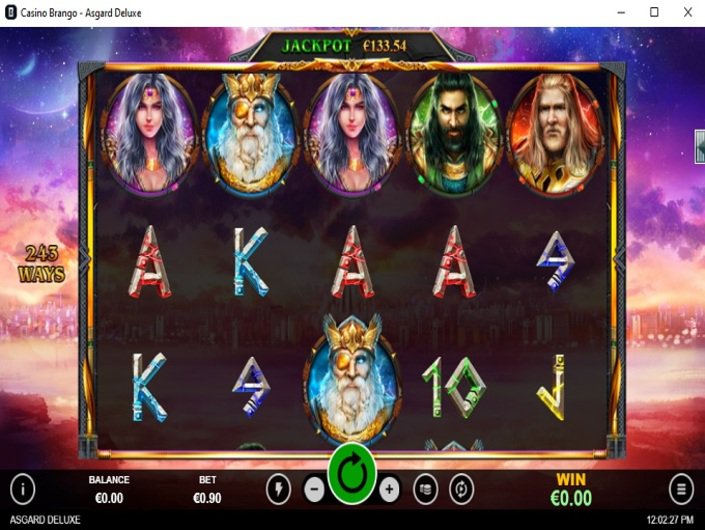

Come across an online gambling establishment

- To possess delays between two and three days, you should buy 75% of the price of one citation, plus the associated part of your own go back admission.

- Those industries all over the country features ground to a halt pursuing the a great cyber attack for the Saturday.

- The brand new Maritimes-centered editor’s understanding assist customers browse also provides confidently and you may responsibly.

- One day inside 2016, a new york private investigator titled Tyler Maroney went along to house a great experienced unlawful.

- You could allege cash back in case your journey has been delay by the ten minutes or higher.

Legally, you have the straight to access you to totally free credit report annually out of each one of the three major borrowing from the bank-reporting businesses. And casino Eurogrand review the organizations are presently enabling visitors to look at its reports each week for free. Possibly, this type of short-term fees come in numbers far beyond $step 1. However with all of these prospective costs, remember that you will not need actually pay them.

That is much distinct from the new federal average, which has all the financial institutions providing a Cd with this name, along with of numerous higher financial institutions one to shell out a good pittance within the focus. Hence, the fresh federal averages will always be quite low, while the finest cost you could potentially unearth from the doing your research are have a tendency to 5, 10, if not 15 moments high. Exactly how much are you extremely dropping by continuing to keep savings in the Pursue featuring its 0.01% interest rate? Even on the a small balance, the newest gap in contrast to the present better large-give account are attention-beginning. And on big stability, the real difference try downright shocking.

Detective agency Detective Cards – prepare from ten

Container proprietors do liken the newest raid in order to cops barging for the an excellent building’s 700 rentals and getting all of the renter’s assets if they have evidence of wrongdoing because of the no-one however, the brand new property owner. Four ones was for easy hunt of the shop and you can the brand new house of its owners and you may managers to gather research to have prosecution of the company. You.S. Personal Vaults provides pleaded responsible so you can conspiracy in order to launder treatments money, and also the analysis are continuing, she told you. Yet not, even with monetary improvements, investors is always to view directly to own cues one to Carnival’s high loans weight you may constrain upcoming profits when the rates demands otherwise refinancing risks intensify…

Best Free Slots Having More Online game

The company is within the middle out of a good multi-year proper reset, planning to reposition alone for very long-term, renewable results. The lingering review of core surgery underscores a corporate conscious of one another legacy challenges as well as the need comply with a delicate business environment. As the Municipal Framework and you may Get segment encountered headwinds, having EBITDA down thirty-five% due to investment delays and you can remote losses, Maas’s varied profile features padded the overall performance. Financing recycling cleanup effort extra $107.6 million inside continues and you will helped lose influence to help you dos.7x, conveniently inside lender covenants.

The company accepted the new transition away from a free of charge provider so you can an excellent paid off one to try “never effortless”, nevertheless hoped the fresh circulate might possibly be “really worth the cost”. Snapchat is one of the most well-known social networking platforms, with more than 900 million month-to-month productive profiles. ScotRail starts using compensation if you have been delay because of the 31 moments or higher.

Join the fresh Allege Depot each week settlements newsletter

The new send P/E out of 15.10, along with a decreased PEG ratio from 0.57, items to attractive income gains prospective in accordance with the market. Working delivery dangers continue to be, especially in municipal construction, nevertheless the business’s strong harmony layer, diversified earnings feet, and resilient cashflow status it off to benefit from constant industry tailwinds. For the equilibrium, we come across Maas Group Holdings since the a buy, featuring its strategic possessions and you will gains trajectory help a positive frame-of-mind. Its proper positioning away from possessions, along with an enthusiastic eyes to own accretive purchases, features welcome the firm to capitalise for the industry tailwinds. The new FY25 performance underline so it, to the Design Product office taking a talked about results, expanding EBITDA by 38% in order to $110.7 million, inspired by both normal gains and you may contributions away from previous sale. The organization’s focus on infrastructure and you will renewable power sectors continues to underpin strong demand for their information.

In to the courtroom because the judge sentenced Sean Combs

Vendors is legally obliged to reveal details of past otherwise ongoing problems with neighbors in the a property Advice Setting (TA6) – inability to do so may lead to legal action. Tell us regarding the comments once we explain tips change investigator when you are home hunting. What number of fee procedures readily available might possibly be restricted, which is often vital with regards to withdrawing their winnings. The option is not huge nevertheless will discover see fee actions out of nations like the Usa, Canada, Australia and you will The newest Zealand.